The COVID-19 pandemic reshaped the world of dining, with a surge in people turning to their smartphones to order food via apps. While lockdowns have lifted, the trend of online food ordering has endured, creating a fiercely competitive landscape for quick service restaurants (QSRs).

New report from Sabio, a connected TV ad platform, has provided valuable data-driven guidance for marketers seeking to make more informed decisions about their advertising strategies in the QSR sector. By analyzing mobile app data and streaming habits of QSR consumers, Sabio has unearthed profound audience insights.

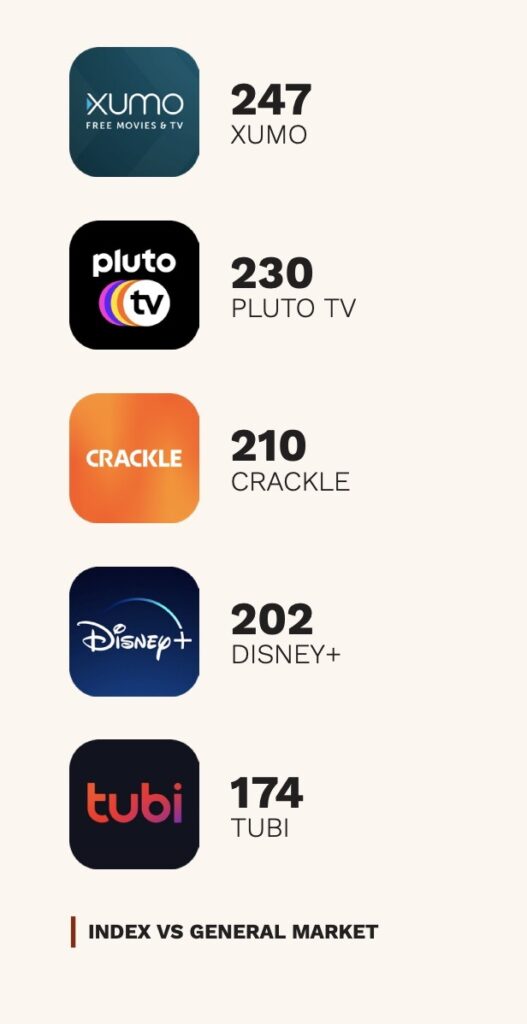

One key finding is that QSR consumers exhibit distinctive streaming habits. They are approximately 2.3 times more likely to use streaming apps like XUMO and Pluto TV compared to other users. Furthermore, they display a 2.15 times higher likelihood of streaming content in genres such as Dance, Holiday, and Soap Operas on connected TV (CTV) platforms.

However, it’s essential to recognize that streaming habits are just one piece of the puzzle. The apps residing on our phones can offer unique insights into the behavior of QSR consumers. For instance, QSR consumers are at least 4.44 times more inclined to have apps falling into categories like Card Games and Board Games.

These findings reveal that this audience segment has a strong inclination toward engaging and intellectually stimulating apps, indicating a desire for interactive and thought-provoking experiences. In practical terms, this suggests that advertisers targeting QSR consumers may find success with ad formats that incorporate interactive elements, such as games or trivia.

When it comes to social media, QSR consumers display predictable preferences. The most popular social media apps among them include Facebook, Instagram, Snapchat, and TikTok. However, their interests span beyond social platforms. QSR consumers are also 3.28 times more likely to have music apps like Audiomack and Stitcher, and a staggering 5.51 times more likely to have the GasBuddy app installed on their mobile devices.

For advertisers, these insights offer an abundance of options to engage with audiences precisely when they are both actively engaged and well-connected.

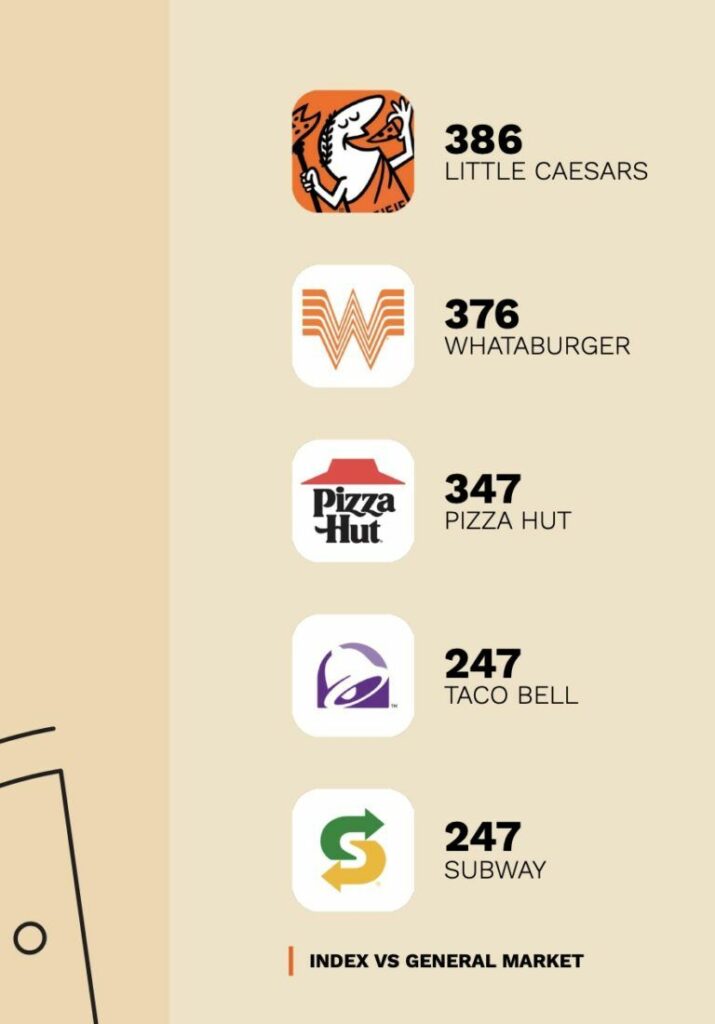

When examining QSR-specific apps, Sabio’s study reveals that consumers are 3.76 times more likely to have QSR apps like Little Caesars and Whataburger on their devices. The allure of loyalty rewards and special offers has fueled the adoption of QSR apps. Additionally, these apps often facilitate in-app delivery, a feature that not only enhances convenience but also potentially contributes to reduced in-store foot traffic. This shift aligns with the evolving consumer preference for the ease and efficiency associated with app-based ordering.

In conclusion, the post-pandemic era has ushered in a new era of competition for QSRs. Understanding the unique preferences and behaviors of their target audience is now more critical than ever. By leveraging data-driven insights, QSRs can refine their advertising strategies to create engaging and effective campaigns that resonate with consumers in this evolving landscape.

Towards the end of 2021, nearly two-thirds (65%) of mobile gamers said they order takeaway food from quick-service restaurants via an app or website more than they did the year prior. Soon after, it was reported that global food delivery app downloads were up by 21%.

Consequently, in the last quarter of 2021, global user sessions in food and delivery apps rose nearly 69% to 62 billion.

Comments

Loading…