Amidst ongoing economic concerns, the US and Europe have witnessed remarkable growth in premium video ad views during the first half of 2023, driven by the expansion of hybrid ad-supported/ad-free models. FreeWheel’s recent Video Marketplace Report provides insights into this thriving ecosystem.

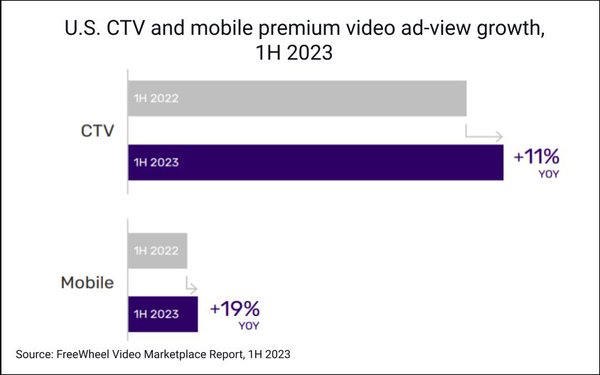

In the US, premium video ad views experienced impressive year-over-year growth of 6%. Connected TV (CTV) ad views surged by 11%, while mobile views saw a substantial increase of 19%. Europe mirrored this success, with a remarkable 15% growth in ad views. Collectively, the US and Europe boasted an average growth of 9% in premium video ad views.

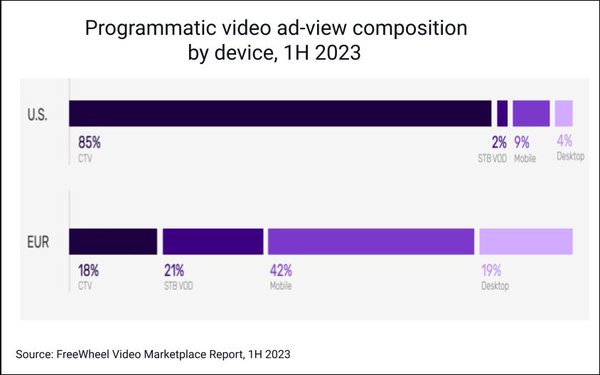

In the US, large-screen viewing remains dominant, with connected TV accounting for 76% of ad views, and set-top box (STB) platforms contributing another 5%. In contrast, just 13% of ad views originated from mobile devices, and 6% from desktops. European audiences exhibit a more balanced distribution, with CTV/STB screens representing 53% of ad views and mobile/desktop screens at 47%.

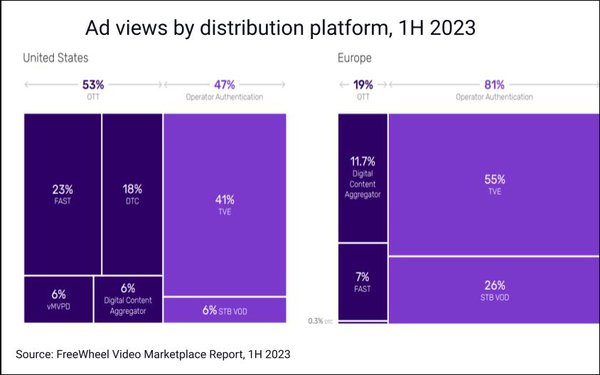

“TV Everywhere” (TVE), authenticated streaming services accompanying cable/satellite subscriptions, is both regions’ most common distribution platform. However, Europe, especially France, shows a higher reliance on STB devices. Notably, free, ad-supported streaming (FASTs) accounts for 23% of views in the US and 7% in Europe.

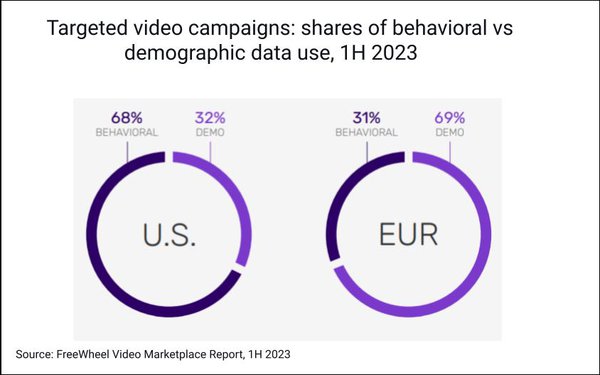

The adoption of audience-based targeting in premium video ads has surged by over 80% in the US, with 68% of targeted campaigns using behavioral data and 32% employing demographics. In contrast, Europe, constrained by GDPR and other regulations, relies more on demographics (69%) than behavioral data (31%).

In the US, programmatic views grew by a remarkable 21% year-over-year, with 85% of these views attributed to CTV campaigns. Europe lagged, with just 8% of programmatic views.

While programmatic advertising is rising, there’s still a desire for more direct paths to publishers and transparency in video impressions. A lack of metadata standardization in CTV and STB inventory poses limitations in this regard. However, it was forecasted that this year, programmatic advertising for digital display is projected to account for 90%of digital display ad spend in the US.

Notably, long-form content continues to dominate, accounting for 70% of ad views in the US and Europe, reflecting viewers’ preference for extended content experiences. This robust growth in premium video ad views indicates the resilience and evolving dynamics of the digital advertising landscape.

Video ads are starting to enter to streaming entertainment with more people choosing to listen to music, podcasts, and watch TV online whenever they please. Spotify, a popular music and podcast platform, and Roku, the top TV streaming platform in the US, Canada, and Mexico, recently announced that they were working together to introduce video ads on the Spotify app that you can watch on your Roku.

Comments

Loading…