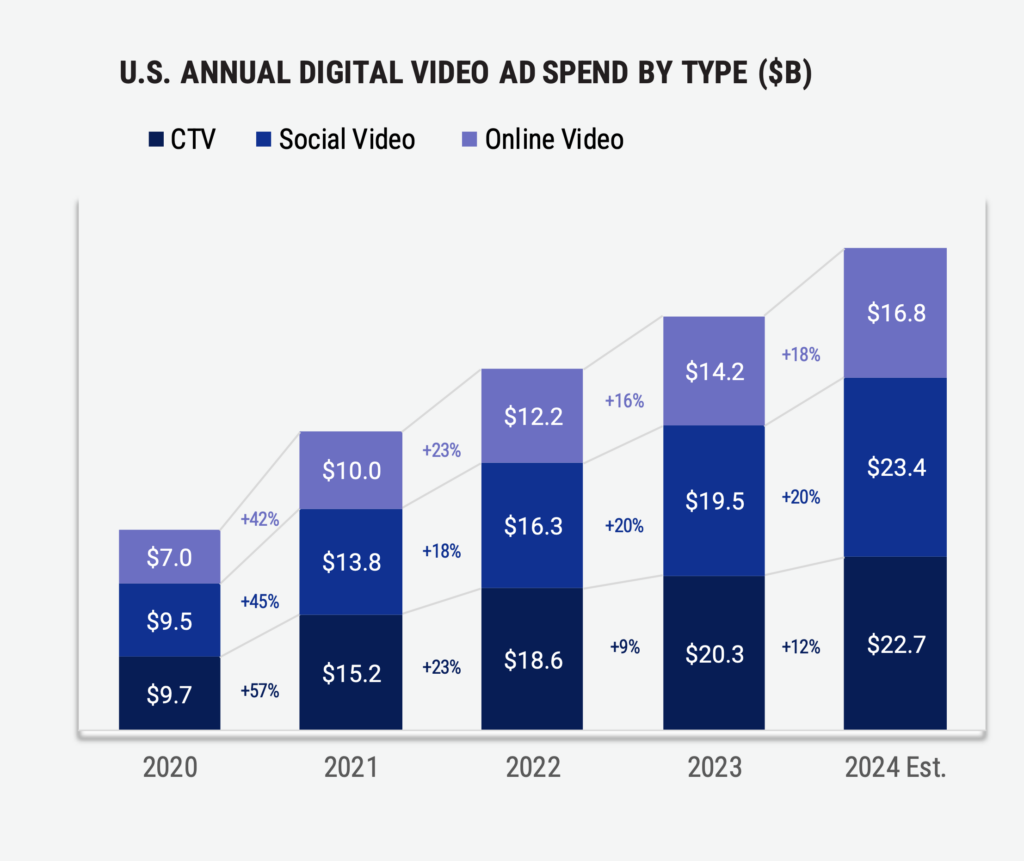

Digital video advertising is on the brink of overtaking traditional linear TV in ad spend, according to the latest findings from the IAB’s Digital Video Ad Spend & Strategy report. In the United States, digital video ad spending, which includes connected TV (CTV), social video, and online video (OLV), experienced a 15% year-over-year increase, reaching $54 billion. This growth trajectory is expected to continue, with a projected 16% increase in 2024, nearly 80% faster than the overall total media spending.

The report indicates that by 2024, digital video ad spend is set to reach $63 billion, claiming 52% of the total share compared to linear TV. Over the past four years, there has been a notable shift of almost 20 percentage points from linear TV to digital video.

Breaking down the categories further, social video emerges as the frontrunner in the digital video landscape. Expected to grow by 20% year over year, social video is projected to reach $23.4 billion by the end of 2024. Meanwhile, CTV is forecasted to increase by 12% year over year, reaching $22.7 billion. With a total spend volume of $22.7 billion, CTV’s market size is anticipated to be 35% larger than OLV in 2024.

The surge in digital video ad spend is being driven by various categories, with consumer packaged goods (CPG) and retail leading the charge. CPG brands, in particular, are capitalizing on CTV’s expanded reach, its ability to engage directly with consumers, and the partnerships between streaming companies and retail media networks. Retail, automotive, and restaurant brands are also finding value in personalized messaging tailored to geographic locations.

The report’s findings underscore the evolving landscape of advertising, with digital video emerging as the preferred platform for advertisers seeking to engage with audiences in an increasingly fragmented media environment. As consumer behaviors continue to shift towards digital consumption, advertisers are reallocating budgets to capitalize on the opportunities presented by digital video advertising.

A recent study revealed that only 8% of advertisers consider Connected TV (CTV) as their top choice for achieving marketing performance through programmatic ad-buying systems. In contrast, web/mobile digital (49%) and social media (41%) are the preferred channels for advertisers seeking marketing performance.

Comments

Loading…