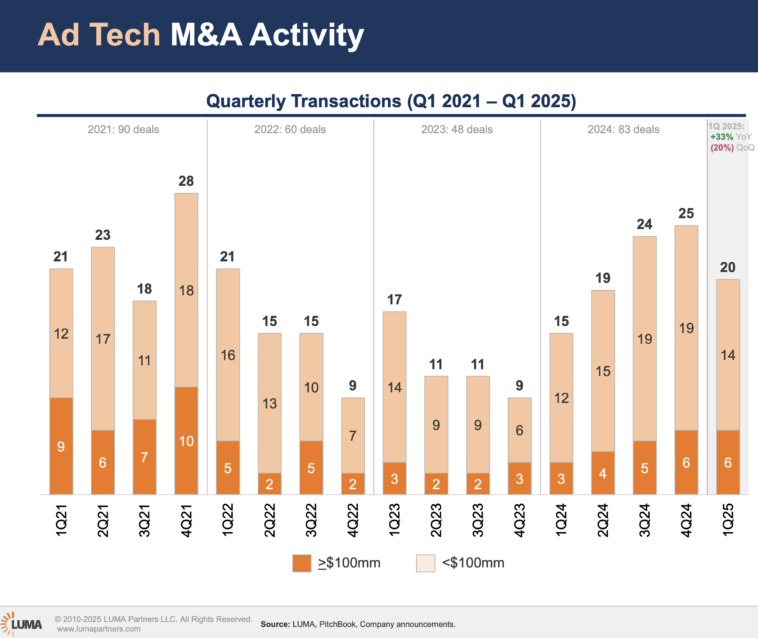

Despite broader macroeconomic volatility and investor unease, the Ad Tech sector showed surprising resilience in the mergers and acquisitions (M&A) landscape during the first quarter of 2025, posting a 33% increase in year-over-year (YoY) activity. However, the strong annual growth was tempered by a 20% drop compared to the previous quarter, reflecting emerging caution in deal-making momentum.

According to LUMA Partners’ Q1 2025 Market Report, the Ad Tech industry completed six scaled transactions (defined as deals with enterprise values over $100 million) in Q1, double the number seen in the same period last year. Key drivers behind this surge included a blend of strategic expansion, technological alignment, and increasing appetite for AI-powered platforms.

“While the QoQ decline suggests a degree of market normalization following a flurry of late-2024 deals, the YoY growth underscores long-term confidence in the category, especially as players look to differentiate with AI, programmatic DOOH, and CTV,” said LUMA Partners in the report.

Among the headline-grabbing deals:

- T-Mobile continued its Ad Tech push, acquiring Vistar Media for $600 million and Blis Media for $175 million to bolster its T-Ads business.

- H.I.G. Capital snapped up Kantar Media in a $1 billion transaction, reinforcing PE interest in measurement and analytics.

- Appier, a public AI-powered SaaS platform, acquired AdCreative.ai for $39 million, signaling a rising trend in AI-centric acquisitions.

- The Trade Desk made its first acquisition since 2017, purchasing Sincera to strengthen transparency in ad data and supply-side signals.

Despite strong strategic activity, the quarterly decline highlights a market grappling with geopolitical tensions, looming tariff threats, and slowing ad spend forecasts. These factors contributed to reduced deal volume compared to Q4 2024, where the pace of activity reached a post-pandemic high.

Looking forward, the report anticipates that Ad Tech M&A will remain robust, albeit more selective. “The ecosystem’s largest players are expected to pursue strategic deals that enhance performance, leverage data, and prepare for the AI-driven future of advertising,” the report noted.

M&A growth wasn’t limited to Ad Tech alone. MarTech also posted a 33% YoY gain, buoyed by consolidation in the customer data platform (CDP) space and renewed strategic interest from public companies like Braze and Shopify. Digital Content M&A saw a more modest 16% YoY growth.

While public markets were less kind—LUMA’s Ad Tech and MarTech indices dropped 16.5% and 17.1%, respectively—the private financing sector hit a high, led by OpenAI’s historic $40 billion round.

Comments

Loading…