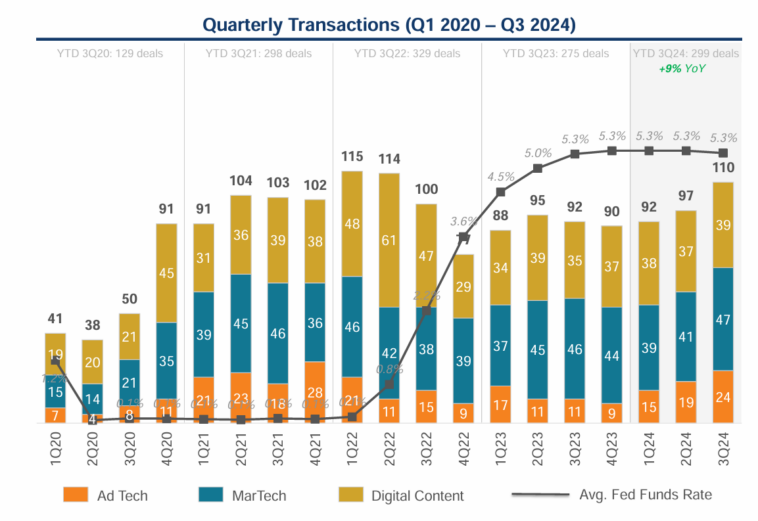

The digital media and advertising technology sectors have seen a significant resurgence in mergers and acquisitions (M&A) activity during Q3 2024, signaling a shift from the sluggish dealmaking landscape of 2023. This year, the macroeconomic environment—highlighted by the Federal Reserve’s first rate cut since the pandemic and the easing of inflationary pressures—has fostered a more favorable climate for strategic investments. The uptick in M&A activity is particularly noticeable in areas like Data/Identity, Connected TV (CTV), Commerce Media, and Mobile, as companies focus on scaling their capabilities to remain competitive and durable in an evolving market. According to LUMA Partners, deal volume in the ad tech space saw a 13% increase from Q2 2024, with significant growth in scaled deals (those valued over $100 million), especially in Ad Tech and MarTech.

The latest report highlights a notable surge in M&A activity within the Ad Tech sector, with a quarter-over-quarter increase exceeding 25%. This uptick includes five strategic transactions, marking the highest volume of large-scale Ad Tech deals since Q3 2022.

Ad Tech M&A maintained its upward momentum from Q2 into Q3 2024, with both year-over-year (+118%) and quarter-over-quarter (+26%) growth in deal volumes. Q3 2024 saw a resurgence in scaled deals, matching the activity levels of Q1 and Q3 2022, highlighted by major acquisitions such as Publicis Groupe’s multi-hundred million-dollar purchases of Mars Commerce and Influential.

In MarTech, M&A activity grew by 15% from Q2 2024, driven by nine significant transactions, reflecting a remarkable 118% year-over-year growth. Meanwhile, Digital Content M&A saw a slight 5% rise in deal volume from the previous quarter, though the number of strategic deals within this space experienced a decline.

The most recent developments underscore a wave of strategic acquisitions and mergers aimed at consolidating and expanding in key growth areas. Samba TV’s acquisition of Semasio and Zeta’s purchase of LiveIntent are some of the notable deals, contributing to the steady flow of transactions across the ad tech sector. Meanwhile, reports suggest that Integral Ad Science could be exploring private equity options for a potential multibillion-dollar acquisition, mirroring the trend set by Outbrain’s purchase of Teads earlier this year. These movements reflect an overarching strategy of “rationalization” in the industry, with companies consolidating their positions or branching into new markets to adapt to the changing landscape.

While the increase in M&A activity is a clear sign of recovery from last year’s stagnation, experts caution that the deals, though numerous, are often characterized as “good, but not great” in terms of transformative potential. Terence Kawaja, CEO of LUMA Partners, noted that while the current deal flow is promising compared to 2023’s lull, most acquisitions are driven by strategic consolidation rather than major breakthroughs. However, the market’s momentum is expected to continue into 2025, with more companies looking to bolster their portfolios through acquisitions in the coming quarters.

The rise in deal activity aligns with the financial recovery of certain ad tech companies, many of which have returned to stronger performance after a period of instability. As Richard McDermott of Rosenblatt Securities noted, the recent interest rate reductions have created a more favorable environment for mergers, sparking greater deal flow as companies look to capitalize on new opportunities in sectors like CTV and retail media. With continued pressure from antitrust regulations and changes in digital privacy policies, companies are increasingly looking to merge in order to adapt and thrive in this complex landscape.

At the same time, the broader digital media and marketing sector has also seen positive growth. M&A activity has surged in the first three quarters of 2024, with a year-over-year increase of 51%, largely driven by strategic consolidations within Ad Tech and MarTech. This trend mirrors the increasing focus on key growth areas that will define the industry’s future, such as AI, content generation, and data analytics. The continued emergence of these sectors, particularly in venture capital funding, suggests that innovation in data and identity is poised to remain a top priority for investors.

Comments

Loading…