Advertisers are reaping greater returns from demand-side platforms (DSPs) in 2024, as nearly 44 cents of every dollar spent now directly engages consumers, up from just 36 cents in 2023. This significant 22% improvement highlights a critical shift in the programmatic advertising landscape, where efficiency and ad quality are taking center stage. According to the Association of National Advertisers’ (ANA) 2024 Programmatic Transparency Benchmark Study, this enhanced productivity represents $8.2 billion in additional effective ad spending in the $104 billion open web programmatic marketplace.

The decline in spending on Made for Advertising (MFA) sites has been a major driver of this improvement. Advertisers have reduced their median spending on MFA sites from 10% in 2023 to just 1.1% in 2024, with average spending falling from 15% to 6.2%. This shift underscores a collective industry move toward more reputable and impactful ad placements. Simultaneously, the number of active domains and apps used in programmatic advertising has nearly halved, dropping from 44,000 to 22,634, signaling a tightening focus on transparency and brand safety.

CTV Advertising Emerges as a Powerhouse in the Programmatic Space

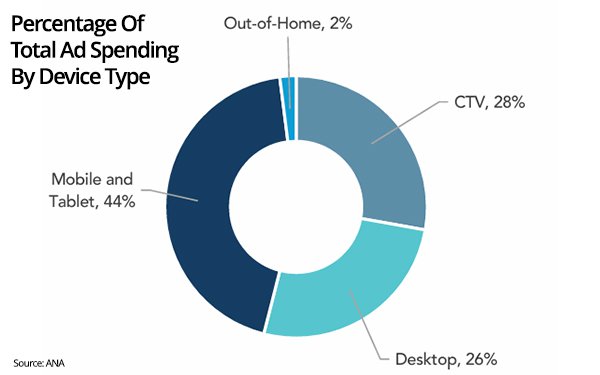

Connected TV (CTV) advertising is rapidly ascending in prominence, with 80% of marketers now utilizing this platform for targeted programmatic campaigns. CTV accounts for 28% of total programmatic ad spending, trailing only mobile and tablet devices, which dominate with a 44% share. The study reveals three key segments of CTV adopters: high investors who allocate over 20% of their programmatic budgets to CTV, moderate investors dedicating between 2% and 10%, and those still hesitant to engage with CTV.

The programmatic CTV landscape is marked by high-value transactions. Nearly all CTV ad spending (97%) is conducted through private Deal IDs, facilitating precise and secure inventory purchases. This approach is concentrated across a small number of dominant supply-side partners (SSPs), with top platforms like Disney, Hulu, and Roku capturing a combined 70% of total CTV ad spend. Such consolidation highlights the growing importance of premium content environments in delivering measurable results for advertisers.

Shifts in Marketplace Dynamics Favor Private Deals

The balance of programmatic ad spending is tipping further toward private marketplace deals. In 2024, 59% of ad spend is directed to private deals, up from 41% in 2023, reversing the prior dominance of open marketplaces. Advertisers are increasingly willing to pay higher costs for better quality and control, with average CPMs rising to $5.82, a sharp increase from $2.23 last year. Private marketplace CPMs average $7.46, significantly outpacing the $3.26 CPM for open marketplace inventory.

This strategic pivot reflects the industry’s focus on ensuring brand safety, reducing ad fraud, and achieving higher viewability standards. Advertisers are aligning their investments with quality over quantity, driven by the elevated CPMs of platforms like CTV, which inherently demand premium pricing. As programmatic advertising evolves, this emphasis on controlled, high-quality ad environments will likely define the next wave of growth and innovation.

Comments

Loading…