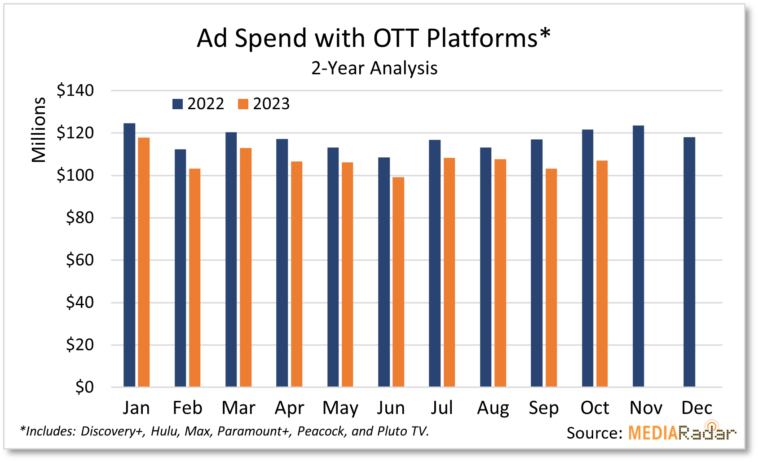

Despite optimistic growth projections for ad-supported streaming, an analysis of six leading platforms—Discovery+, Hulu, Max, Paramount+, Peacock, and Pluto TV—reveals a collective ad revenue dip. According to data from MediaRadar, these platforms generated $1.07 billion in ad revenue from January to October 2023, marking an 8% YoY decline compared to the $1.2 billion generated during the same period in 2022.

Factors such as escalating content expenses, password sharing impact, and economic uncertainty are cited by MediaRadar CEO Todd Krizelman as challenges impacting downstream subscriber and advertising dynamics across the streaming industry.

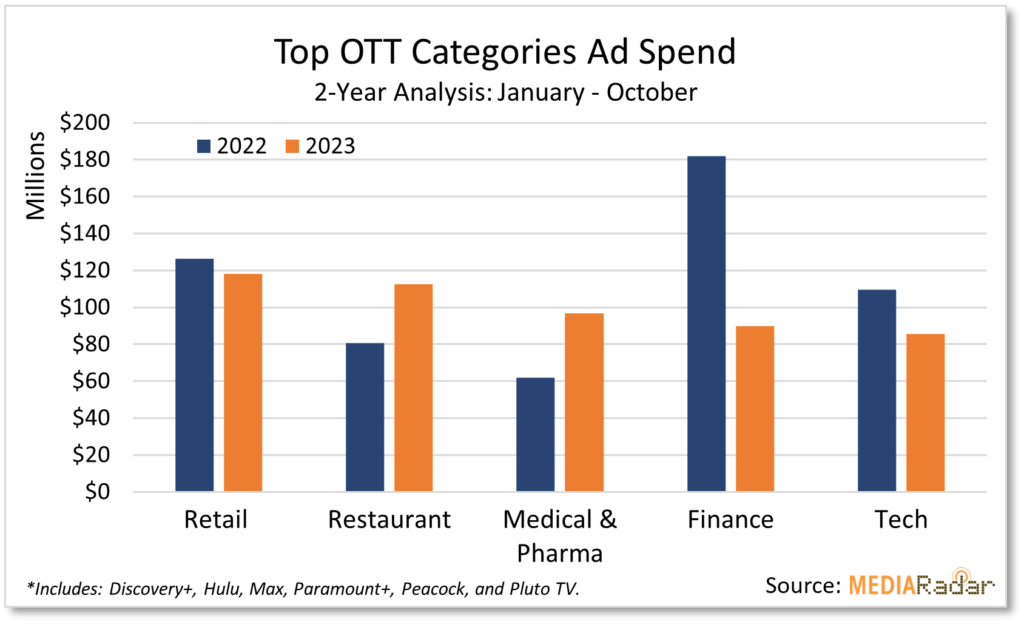

The analysis highlights that five categories—restaurant, medical/pharma, finance, retail, and technology—contributed nearly $503 million, constituting 47% of the total ad spend for these platforms through October. However, this reflects a collective 10% YoY decline.

Among these categories, the finance sector witnessed a significant drop, decreasing from $180 million in 2022 to just over $80 million in 2023. Major insurers, including GEICO, State Farm, and Progressive, slashed their spending by 74%.

In contrast, the restaurant and pharma sectors experienced YoY increases in ad spend, rising by 39% and 56%, respectively. Quick-serve restaurants, representing a significant portion of the restaurant category’s spend, surged 38%, with brands like McDonald’s, Taco Bell, and Subway intensifying their OTT ad investments.

Pharma companies, including AbbVie and GlaxoSmithKline, saw a 66% YoY increase in spend, with substantial contributions in arthritis prescriptions and OTC hair growth products.

Retail advertisers, accounting for 14% of Discovery+’s ad spend, saw general retailers like Target and Walmart contributing 28%. Technology advertisers, constituting 19% of Max’s ad spend, were led by telecommunications companies like AT&T and T-Mobile, followed by software firms such as Adobe, Canva, and IBM.

While challenges persist, streaming platforms are adapting to market dynamics, and specific sectors, like restaurants and pharma, are strategically leveraging streaming platforms for advertising.

Expanding into premium platforms and smaller FAST networks, the ad-supported streaming services landscape witnesses a notable 60% drop in cost-per-thousand viewer prices (CPMs) in the current fourth quarter, plummeting to $21.73 from $35.06 in the corresponding period last year, as reported by Insider Intelligence/eMarketer.

Comments

Loading…